112223 Wednesday update

November 22, 2023 5 Comments

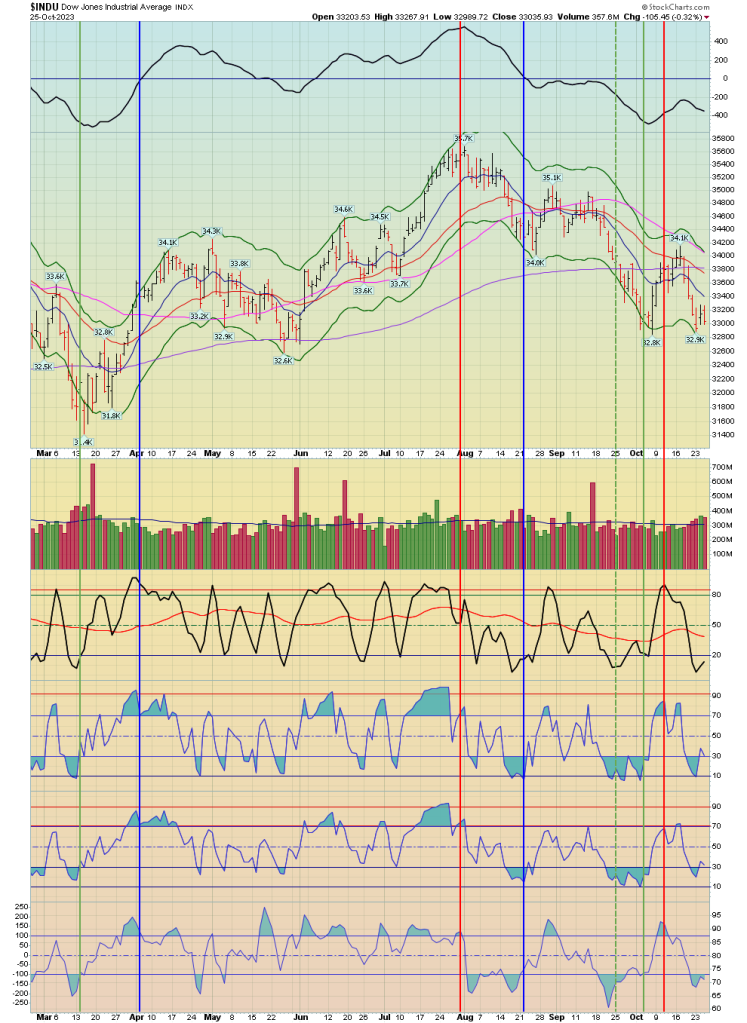

SP500 STORMM SIGNAL: Buy fully validated BUY (Nov 3)

SP500: The SP500 has advanced significantly confirming further the STORMM buy signal from Nov 3rd. The rally has been so strong it has generated a very bullish Zweig signal.

Recent STORMM indicators have also generated two failed sell signals which signal minor retreats to be followed by a renewed rally.

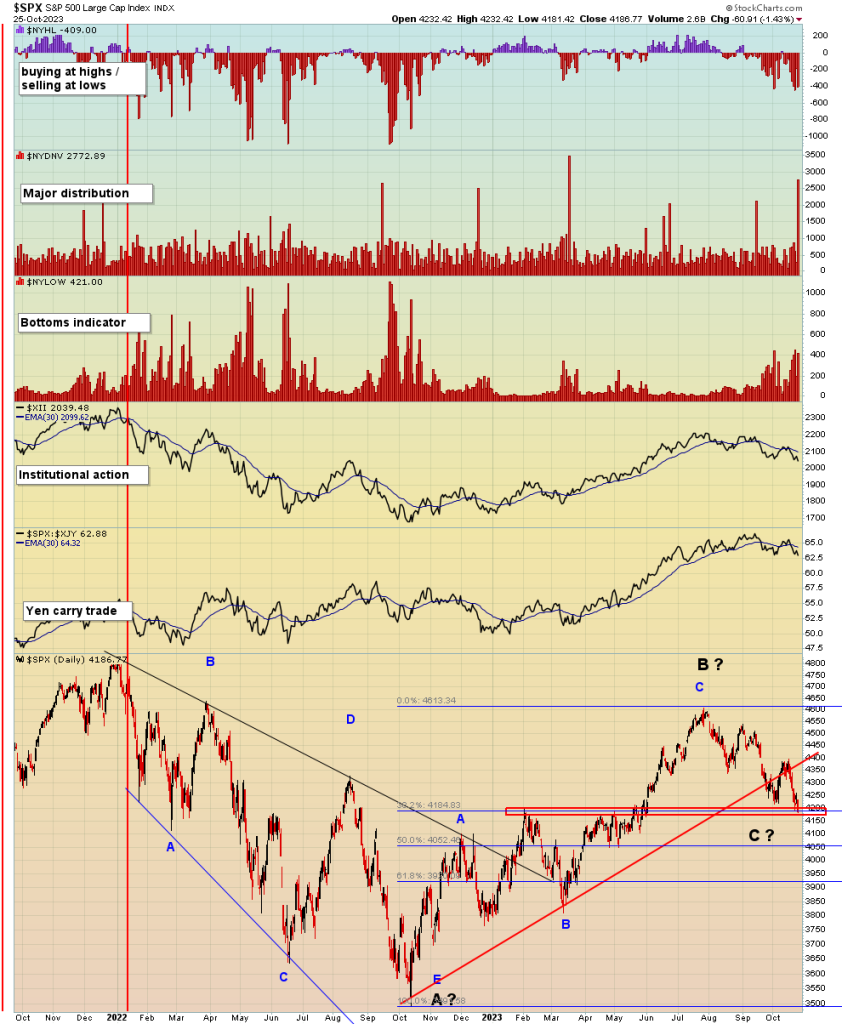

Finally, the technical structure of the on-going bear market is not looking “right” and the “C” leg down that we mentioned recently as having completed at the last STORMM buy signal from Nov 3rd could actually be just the “A” wave of the “C” wave retracement. This interpretation would then assign the current rally as a three wave “B” wave which could fit other technical charts above as a strong rally that could reach new highs. The final move would be a “C” wave of “C” down into the spring or summer of 2024 which aligns with the key decisions by the Fed on rates and bank liquidity. Weather this coming “C” wave is the final move in the bear market since 2022 remains to be seen. We’ll be using the STORMM indicators to signal major trend changes.